XA35P – Warning! Investor Ruin Fueled by Trust and Social Media Tactics

XA35P – Stay Away! Crypto Illusion, Investor Damage, and Social Media Control

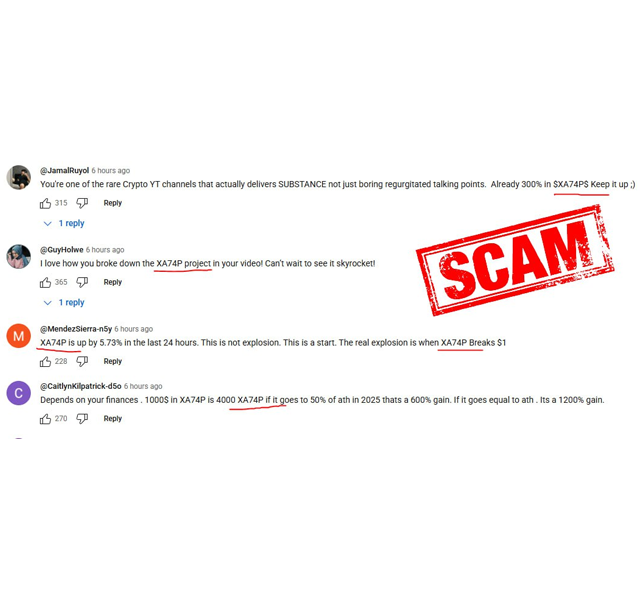

The aggressive expansion of the cryptocurrency market has provided fertile ground for complex financial fraud, particularly schemes that exploit the personalized nature of social media. The fraudulent operation known as XA35P is a stark example of a “pig butchering” scam—a long-game deceit where victims are meticulously cultivated before their capital is irrevocably seized. This process highlights social platforms as the primary vector for sophisticated asset misdirection.

The Initial Lure: Engineering Trust

The journey into the XA35P scam began on popular social networks, including Facebook, Instagram, LinkedIn, and online dating apps. Perpetrators utilized two carefully constructed identities to initiate contact:

The Casual Connector: Individuals received unexpected direct messages (DMs) from a seemingly successful, friendly stranger. The initial message was often a feigned error before the conversation casually pivoted to personal finance, with the contact touting an “exclusive” crypto trading strategy as the source of their wealth.

The Financial Expert: The XA35P team created highly convincing professional profiles and deployed targeted advertisements showcasing aspirational, high-end lifestyles and fabricated client success stories. This tactic aimed to establish the operation as a legitimate, high-yield investment authority, sometimes even co-opting the likenesses of established financial figures.

Strategic Isolation: Fostering Intimacy

Once a target displayed genuine interest, the scammer’s paramount objective was to migrate the dialogue away from public oversight and onto encrypted private messaging services like WhatsApp or Telegram. This strategic relocation served two key functions:

Operational Security: It shielded the fraudulent communications from the general monitoring systems of the social platforms.

Emotional Capture: The private environment facilitated a sense of exclusive mentorship, with relationships often evolving into personal or even romantic bonds, deepening the victim’s emotional commitment and unwavering trust in their supposed mentor.

The Controlled Environment: Simulating Success

Instead of directing funds to a recognized, regulated cryptocurrency exchange, the XA35P operators steered investors to a proprietary trading platform entirely designed and managed by the criminal organization. This simulated environment was engineered for maximum deception:

Professional Façade: The platform boasted a high-fidelity interface, complete with realistic market displays and a seemingly responsive customer support portal, all simulating legitimacy.

Fabricated Gains: Initial, small investments were shown to generate extraordinary, rapid returns, based exclusively on the scammer’s “expert signals.” To solidify belief, the victim was typically permitted to process a modest withdrawal, thus validating the system’s apparent functionality.

This illusion of guaranteed, effortless wealth encouraged victims to commit progressively larger amounts—often draining personal savings, retirement funds, or taking out credit—in pursuit of the visualized, multiplying account balance.

The Inevitable Freeze: Final Capital Forfeiture

The victim’s realization of the fraud occurred when they attempted to withdraw their accumulated, substantial profits. The true nature of the XA35P scheme was revealed not by an admission of guilt, but by a series of uncompromising demands and punitive fees:

Unforeseen Financial Blockades: The withdrawal request was denied, and the victim was informed they first had to remit significant external funds to cover fictitious “regulatory charges,” “transfer fees,” or “tax contributions” before any payout could be processed.

Fictitious Audits: Perpetrators also cited fabricated “compliance reviews” or “anti-money laundering audits” that required an additional, large deposit to release the account’s funds.

After paying these initial ransom demands, the victim was either met with a succession of new levies or, eventually, total silence, as the perpetrators vanished and the fraudulent platform was shut down. The result is the complete and absolute forfeiture of all invested capital.

The XA35P incident underscores the critical danger in the digital investment arena. It serves as a strong caution: individuals must treat any unprompted investment offer promising extraordinary, low-risk gains with the highest degree of suspicion to safeguard against the permanent loss of their funds.